“Composition Scheme Return” has been added to your cart. View cart

Description

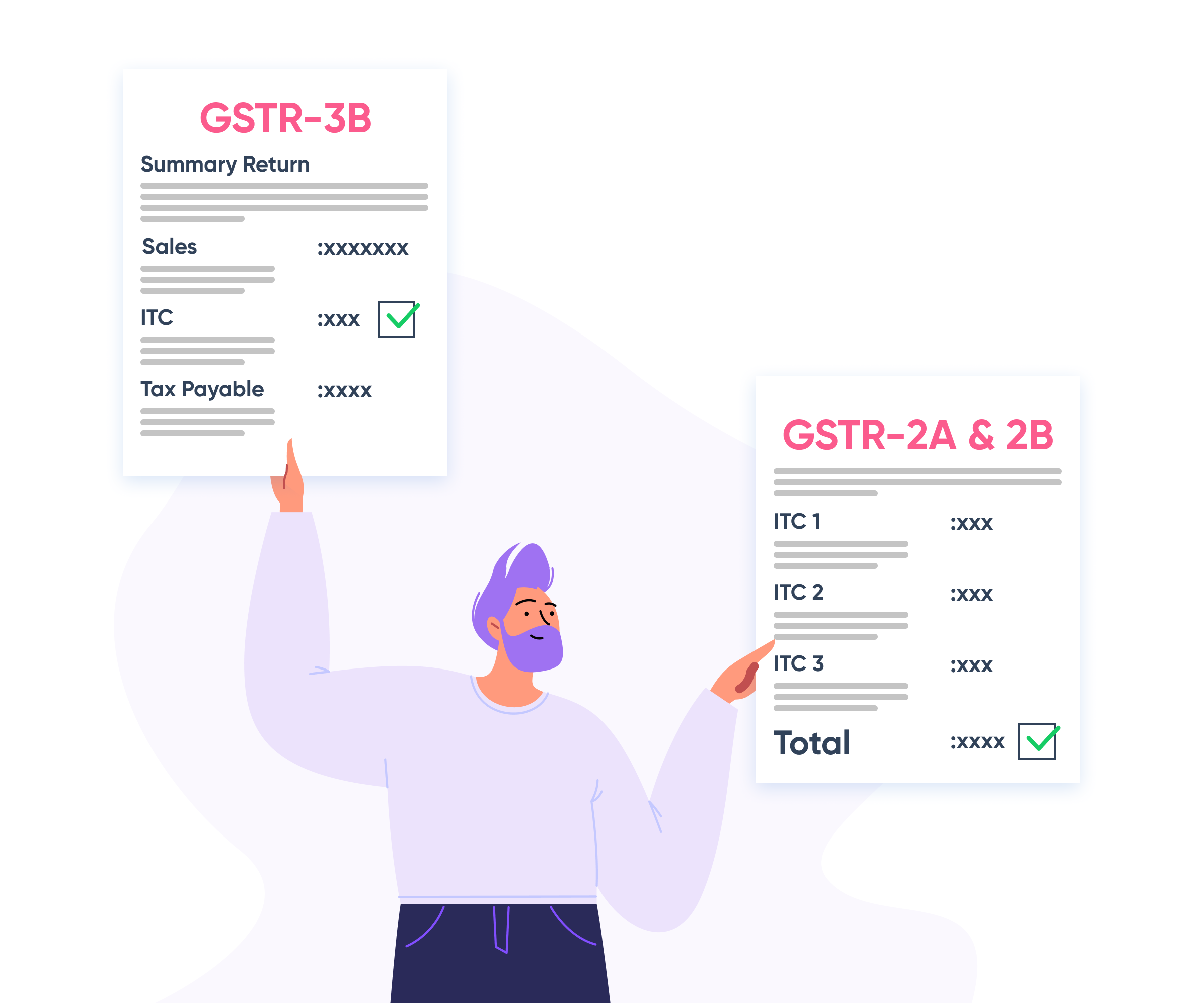

- A separate GSTR-3B must be filed for every GSTIN

- The GST liability must be paid on or before the date of filing GSTR-3B, earlier of its due date

- The GSTR-3B once filed cannot be revised

- Even in case of a zero liability, GSTR-3B must be compulsorily filed

Loading...

Related products

-

Sale!

GST AMMENDMENT

₹1,000.00Original price was: ₹1,000.00.₹500.00Current price is: ₹500.00. Add to cart -

Sale!

PARTNERSHIP FIRM

₹5,000.00Original price was: ₹5,000.00.₹4,500.00Current price is: ₹4,500.00. Add to cart -

Sale!

GST REGISTRATION

₹2,999.00Original price was: ₹2,999.00.₹2,499.00Current price is: ₹2,499.00. Add to cart -

Sale!

GSTR-9C (ANNUAL)

₹7,500.00Original price was: ₹7,500.00.₹7,000.00Current price is: ₹7,000.00. Add to cart

Reviews

There are no reviews yet.